The Vietnam Silkworm (Visiting Corporation), also known as Viseri, was established in early 1996, on the basis of the reorganization of the Vietnam Silkworm Union in order to find a stable development direction for the silkworm silk industry. integration period.

However, after 16 years of operation, Viseri left behind a series of grove related to the leadership team as well as the business situation. By the end of fiscal year 2011, Viseri was one of two state-owned corporations with negative equity of VND281 billion.

Equitization Decision

According to MARD's decision, PTNT dated 14 September 2012 on the financial restructuring plan to convert Viseri into a joint stock company.:

State 1 Treating the owner's equity to enable Viseri to qualify as a joint stock company.

M & A; According to PTNN, as of September 30th 2011, Viseri's business value was VND 327.5 billion, equaling VND 122.8 billion. As such, DATC has a debt restructuring obligation of VND122.8 billion, equivalent to the negative equity capital of the company so that the company is eligible to convert into a joint stock company

State 2: DATC is responsible for dealing with financial incidents from the time of valuation of the enterprise (30/9/2011) until the time Viseri becomes a joint stock company. If there is a loss due to objective reasons, DATC shall continue to consider and handle the current regulations.

Actual situation

According to a report by the Ministry of Finance, Viseri's equity fell to 281 billion by the end of 2011, doubling from the end of Q3. As such, DATC's mission may not be the same at 122.8 billion dong.

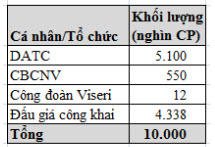

In November, Pham Thanh Quang, General Director of DATC reported that DATC expects DATC to cancel another VND30 billion debt for Viseri after its successful equitization. As scheduled, the total number of shares issued by Viseri is 10 million shares, distributed as follows:

As of November 20, 2012, 7 new investors registered to buy shares, including 1 investor and 6 individual investors. The total volume of shares registered to buy 861,400 shares, less than 20% of the volume of shares offered. The deadline for submitting the auction slip has been closed.

With the starting price of 10,000 dong, each investor will be offered 02 prices, the maximum price

Viseri can earn about 8.6 billion through this public auction.

According to Article 40 of Decree No. 59/2011 / ND-CP dated 18 July 2011 on transferring SOEs into joint stock companies, if Viseri does not sell all the shares offered, the Steering Committee will report The competent authorities decide to approve the equitization plan to adjust the charter capital structure to convert 100% state-owned enterprises into companies.

CP before holding the first shareholder meeting.

This morning, Nov. 22, the share auction of Viseri will take place at the Hanoi Stock Exchange. We will give more information about this auction result.

Minh Thư

thunm